Hello Bubble Riders!

Let’s start with a hard truth: the most boring part of your bubble portfolio should be where you spend most of your time. That’s right. Not the moonshots, not the small caps with Discord cults, not even Doge. The slow stuff. Because if you can boost the performance of your “boring” base layer, two things magically happen:

- Your total returns go up.

- Your volatility goes down.

That means you’re less likely to panic-sell your way into a permanent 20% haircut.

I try to motivate each newsletter with some performance data. Unfortunately, for legal reasons, I can’t show you results from our actively managed funds. But I can show you data from a non-offered strategy that’s built for stability … and the upside still hits nicely.

This particular strategy runs ~⅔ delta neutral and ~⅓ BTC exposure through an AI algorithm. During the recent stretch of tariff chaos and Twitter outbursts from The Orange Swan himself, it still posted a 23% CAGR and a Sharpe of 2.89. In calmer simulations, the strategy clocks in around 29%–34% CAGR.

The secret sauce? Delta neutral positioning.

That’s a fancy way of saying: “the strategy is designed to make money whether prices go up, down, or do the Macarena.” Let’s slow walk this because it matters.

What Is Delta Neutral?

In plain terms: you’re not betting on where market price goes (the change in price = the delta). You’re betting on how it pays you to wait. We’ll examine liquidity provisioning, which earns you funds by giving you fees by allowing others to swap tokens.

In traditional finance, this delta neutral strategies have become the domain of hedge funds. But with decentralized finance (DeFi), if you’re willing to read some documentation and log in daily, you can manage a 9%–26% APY strategy yourself.

I’ll show you how.

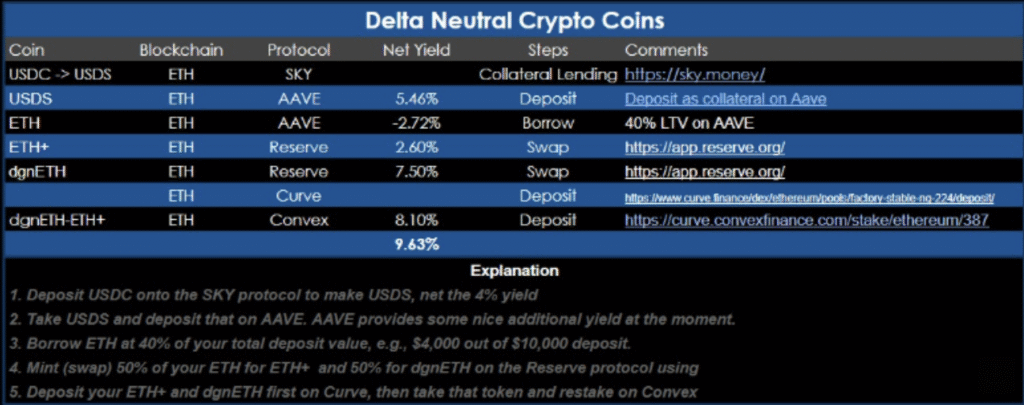

Above is a strategy that recently jumped to just over 22% annualized. But for a stable portfolio, you need to get a sense of what a “bad” week of annualized returns looks like. Featured in the image is another week, with an annualized yield of 9.63% (net yield column at the bottom).

So, how do you build it?

How To Build A Delta Neutral Strategy With Liquidity Provisioning

We’ve been feeding this strategy to premium subscribers for literal years. Most still won’t touch it, because it’s complex. And sadly, “click here to farm 20% APY” isn’t a real button, no matter how many influencers pretend it is.

At the core, this is a carry trade:

- You borrow cheap (1.5%–3%) and earn rich (8%–27%). You keep the spread. That’s the whole trick.

- If the rate you’re earning is higher than the rate you’re borrowing at, you win.

And if that sentence bored you, congratulations, you now understand how every major investment bank on earth makes money.

In the DeFi jungle, stablecoin yields are usually safe but sleep-inducing. Think 5% APY with the excitement of a municipal bond. Meanwhile, ETH yields are higher, but come with the emotional stability of a toddler on a sugar crash.

So, can we have both?

Turns out, yes. If you’re clever with your collateral, you can borrow against a stable asset (USDS) and farm juicy ETH yields, without needing to know your moon phases or memorize Vitalik’s blog posts.

We’ll walk you through one version using USDS, the rebranded DAI from Maker (now called Sky, because apparently branding consultants charge by the vowel), and yield-bearing ETH variants, namely ETH+ and dgnETH from Reserve Rights.

Your other counterparties are Maker (now Sky), AAVE, and Curve. So, these are all established protocols–about as “blue chip” as you can get in the crypto world.

And here’s why this works.

The juicy yield you’re after is made up of three parts: (1) staking rewards, from protocols like Lido, (2) incentive tokens earned from providing liquidity on Curve (and then boosting it via Convex), and (3) fees from people swapping the coins.

Put that together, and you’ve got a yield engine that earns off other people’s swaps, validator rewards, and your willingness to click a few more buttons than your average yield chaser.

In short: it’s a carry trade, with training wheels made of ETH.

How Do You Execute This Strategy?

This is the complex part that defeats most people. Remember that your premium is earned in part through your ability to learn the technology that others are unwilling to learn. There are five basic steps involved and I’ll explain assuming you were going to use $10,000 to keep the math simple. All of this is on the ETH main L1.

Step 1: Deposit $10,000 of USDC into the Sky protocol to get USDS

Step 2: Deposit that $10,000 of USDS onto AAVE.

Step 3: Borrow about 40% of that value (so $4000) in ETH.

Step 4: Go to Reserve.org and swap for that ETH for equal amounts of ETH+ and dgnETH.

Step 5: Make the relevant ETH+ – dgnETH liquidity pool on Curve.

Step 5a: Go to Curve and deposit those two coins (ETH+ and dgnETH) into the LP pool that gives you an LP token.

Step 5b: Go to Convex and deposit that LP token there for yield.

Congratulations, you’re now a DeFi yield farmer. Expect no parades.

Managing Returns Like a Grown Up

This strategy makes more when coin values are rising. Specifically, when ETH and CRV tokens are rising. In general, that’s a good thing, but it’s worth thinking through the mechanics.

Suppose ETH rises substantially.

- Because your initial loan is in ETH against USDS, if ETH rises too quickly, you may need to “top up” your collateral amount on AAVE. You’ll go from 40% LTV to 60% quickly.

- While you could borrow more than 40% initially, and juice your returns, it’s safer to keep that borrowed level low so you can manage your collateral ratio.

Suppose ETH drops substantially.

- You are protected against US dollar declines. Your loan on AAVE is denominated in ETH. If you borrow 10 ETH, then you need to repay 10 ETH – no matter if 1 ETH is worth $1000 or $10,000. What is affected in your strategy is your yield.

- If ETH loses half its value, then your loan ratio will drop from 40% to 20% and you’re effectively borrowing half as much. Your yield will drop and so you need to borrow more.

In short: You need to check on this daily. But it’s mostly plumbing, not rocket science.

Concluding Thoughts

This strategy reminds me of Joel Greenblatt’s cheeky book, You Can Be a Stock Market Genius. He made billions from spinoffs, mostly because no one else bothered to read the footnotes.

Same here.

The real edge in DeFi is showing up and doing the homework. This strategy will not make you rich overnight. But it will make you one of the few people who understands how to generate stable yield without playing roulette on token prices.

So take the path less traveled. Wander down the delta neutral way.

If nothing else, it beats letting your cash earn 0.45% in a savings account while your bank thanks you by buying more marble.

Happy Trading!

– Sebastian Purcell, PhD

Assisted by Nicole Zinuhova

P.S. If you found this helpful, you’ll probably also find the AOTB full course even more helpful.

Disclosure: This communication is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security. Offers will only be made to accredited investors pursuant to Regulation D, Rule 506(c), and in accordance with applicable securities laws. All investments carry risk, including the potential loss of principal. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Past performance is not indicative of future results.